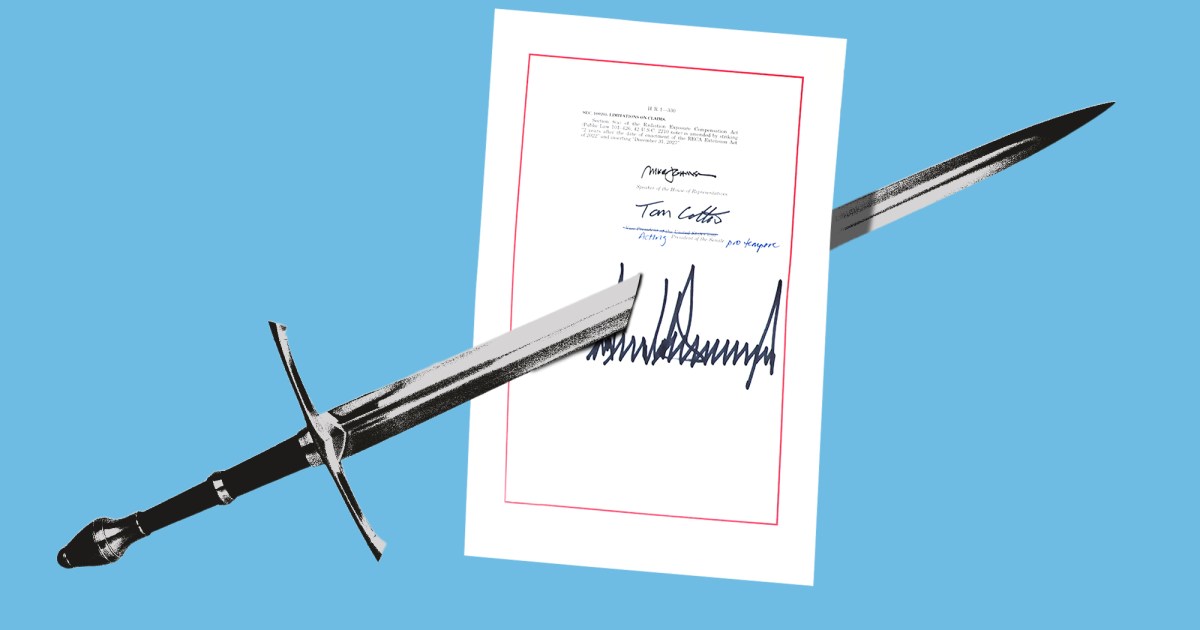

It is apparently not enough for America’s anti-tax crusaders that Congress just passed one of the most expensive and regressive tax bills in our history. The Washington Post reports that Grover Norquist’s Americans for Tax Reform and other conservative groups are now urging the Trump administration to change how investment profits are taxed—unilaterally, if need be—in a way that would overwhelmingly favor the wealthiest Americans.

Sound familiar?

Namely, they want to index capital gains to inflation. Suppose I bought $100,000 worth of Apple stock on July 10, 2020 and kept it. Today, I could sell that stock for $170,383—a tidy $70,383 profit. That’s a 74 percent overall return and an average annual return of 11.7 percent. Pretty good, right?

Not good enough for Norquist et al.

These players want to let me adjust the “cost basis”—the price I originally paid for the stock—for inflation. Using this inflation calculator, I could then tell the IRS that my initial $100k investment was in fact a $120,407 investment, and so my profit for tax purposes is only $40,976.

This is insane—for several reasons.

First, read the room. Congress just passed a megabill whose benefits are deeply skewed in favor of the wealthy. Its tax provisions and spending cuts, taken together, will result in a 4 percent increase in average after-tax income for the richest 1 percent of American households and a nearly 4 percent decrease for the poorest 20 percent, based on the Yale Budget Lab’s analysis. This is very, very unpopular.

The bill will at least $3.3 trillion to the national debt—more like $5 trillion if expiring provisions are extended in the coming years. And indexing capital gains to inflation, according to 2018 estimates from the Tax Policy Center and the Penn Wharton Budget Model, would add yet another $100 billion to $200 billion to the tab—with the richest 1 percent reaping 86 percent of the benefits.

“I don’t think reducing [capital gains rates further] will change investor behavior,” says billionaire Mark Cuban.

Norquist told the Washington Post he recently spoke with President Donald Trump and recommended the president implement the change with an executive order. Indexing capital gains to inflation was considered during Trump’s first term, the Post‘s Jeff Stein reports, but Treasury Secretary Steve Mnuchin felt Congress should handle it—current secretary Scott Bessent may prove more complaint. “I said something like, ‘Mr. President, after we do the bill, we will need more economic growth,” Norquist told Stein. “The Big Beautiful Bill is very pro-growth, but with this, we can have even more growth.’”

In reality, not one of the Republican tax packages enacted since Ronald Reagan became president has lived up to its sponsors’ economic promises. “The economy may well enjoy a sugar-high the next couple of years, as borrowing stimulates near-term consumption,” Maya MacGuineas, president of the nonprofit Committee for a Responsible Federal Budget, said in a statement after Congress passed the “One Bie Beautiful Bill” on July 3. “But a sugar-high won’t be sustained, it will do real damage, and often what comes next is the crash.”

As for the notion of indexing fueling “more growth,” the billionaire investor Mark Cuban told me in an email that he thinks the current tax rates on capital gains are fair, and “I don’t think reducing it will change investor behavior.”

Yet the fairness of those rates—and their justification—is the subject of fierce debate. Suppose I’m a wealthy investor and I sell assets I’ve held for at least 12 months—stocks, bonds, real estate, or even, say, a stud racehorse—netting my family $1,000,000 in profits. The federal tax on those capital gains ranges from zero for the first $94,000 to 20 percent for the portion that exceeds $583,750. Because my spouse and I have income of more than $250,000, we also have to pay a 3.8 percent “net investment income tax.” This all adds up to an effective tax rate of about 19 percent.

But tax rates for wage income are much higher. A couple reporting $1,000,000 in salary income pays an effective rate of about 30 percent. That’s a huge difference, and part of why families whose money comes from primarily from asset growth have amassed wealth so much faster than working families have. It no lefty exaggeration to say America’s economic system is rigged against workers and in favor of investors. It’s right there in the tax code.

“This kind of proposal will only widen the economic inequality we’re facing.”

So how do conservative policy wonks justify the low capital gains rates? A key argument, interestingly, is that inflation eats away at the value of long-term gains. One “solution” would be to index the gains to inflation, notes the libertarian Cato Institute, “but most countries instead roughly compensate” by offering reduced tax rates for investors.

And now the anti-taxers want to have it both ways.

Investors enjoy other economic advantages, too. Notably, their gains are counted as income only when the assets are sold. In practice, this allows people with a large portfolio of appreciated assets to borrow against their holdings at single-digit interest rates and live off those loans instead of selling assets and paying a double-digit tax. As ProPublica discovered, many of America’s wealthiest families have been doing precisely that. (As a result, from 2014 to 2018, Jeff Bezos paid an effective income tax rate of less than 1 percent.)

Or say you have a $100 investment that grows by 10 percent a year during a period of 2 percent annual inflation. The first year’s profit, after inflation, is $8. “But I don’t pay tax on that $8 until I sell, which may be decades later,” says Bob Lord a former tax attorney and associate fellow at the Institute for Policy Studies. “I’m basically getting a free ride on the appreciation of that $8 portion of my investment.” Doesn’t that benefit, he asks, more than offset any detriment from inflation?

And also, isn’t investing supposed to contain an element of risk management? Isn’t the ability to beat inflation part of what separates a savvy investor from a useless one? Indexing for inflation, combined with favorable tax capital gains rates and an exemption for unrealized gains—doesn’t that basically reduce investing to shooting fish in a barrel?

It is worth noting, too, that most Americans work for a paycheck, and the ones who make their living via investing are by and large quite wealthy. More than half of Americans now own some stock, but not much. As of January 2024, per Federal Reserve data, 93 percent of US stock holdings were owned by the most affluent 10 percent of the population, and the richest 1 percent owned more than half of all public equities—not to mention private equities.

Indexing gains to inflation “would really codify the notion that income taxes are only for people who work for a living,” says Morris Pearl, a former managing director at BlackRock and current chairman of the board of Patriotic Millionaires, a nonprofit that advocates for higher taxes on the rich.

If the Trump administration were to attempt the change Norquist recommended—unilaterally or otherwise—its not even clear how it would work. You would presumably need to make changes on both the profit and loss sides of a balance sheet. Kyle Pomerleau, a senior fellow with the right-leaning American Enterprise Institute, has concluded that indexing is complex and unlikely to generate significant economic impact, and is therefore “more trouble than it’s worth.”

“Indexing has been rejected in the past to avoid opening new tax shelters,” says Steven Rosenthal, a Washington tax policy expert and former legislation counsel for the congressional Joint Committee on Taxation. “If investors were permitted to index their assets, but not required to index their liabilities, debt-financed investments would explode. Investors could exclude profits and deduct interest. But indexing both assets and liabilities is a mess, which I, as a congressional staffer, discovered when we tried to draft it.”

“This kind of proposal will only widen the economic inequality we’re facing,” adds Patriotic Millionaires’ Pearl. “It’s absurd that all I would need to do is buy property that I can rent out, and make a lot of money, and never have to pay taxes again!”

From Mother Jones via this RSS feed